MS LENDING GROUP

CHALLENGE

MS Lending Group provides bridging finance for residential, semi-commercial, and commercial properties. With the ability to offer funds within 24 hours, they wanted to strengthen their digital presence to better showcase their speed and reliability, while cementing their position in the market.

Full Send’s first step was to deliver a complete website design and development project, creating a modern, conversion-focused platform that reflected MS Lending Group’s strengths and ambition. Building on that foundation, Full Send devised an SEO strategy aimed at boosting the company’s online visibility for key bridging finance terms and ensuring they could consistently outperform competitors in organic search results, optimising for both search engines and emerging answer engines.

RESULTS

BRAND AWARENESS

+290% KEYWORDS GROWTH

WEBSITE TRAFFIC

+34% INCREASE

LEAD GENERATION

+48% INCREASE

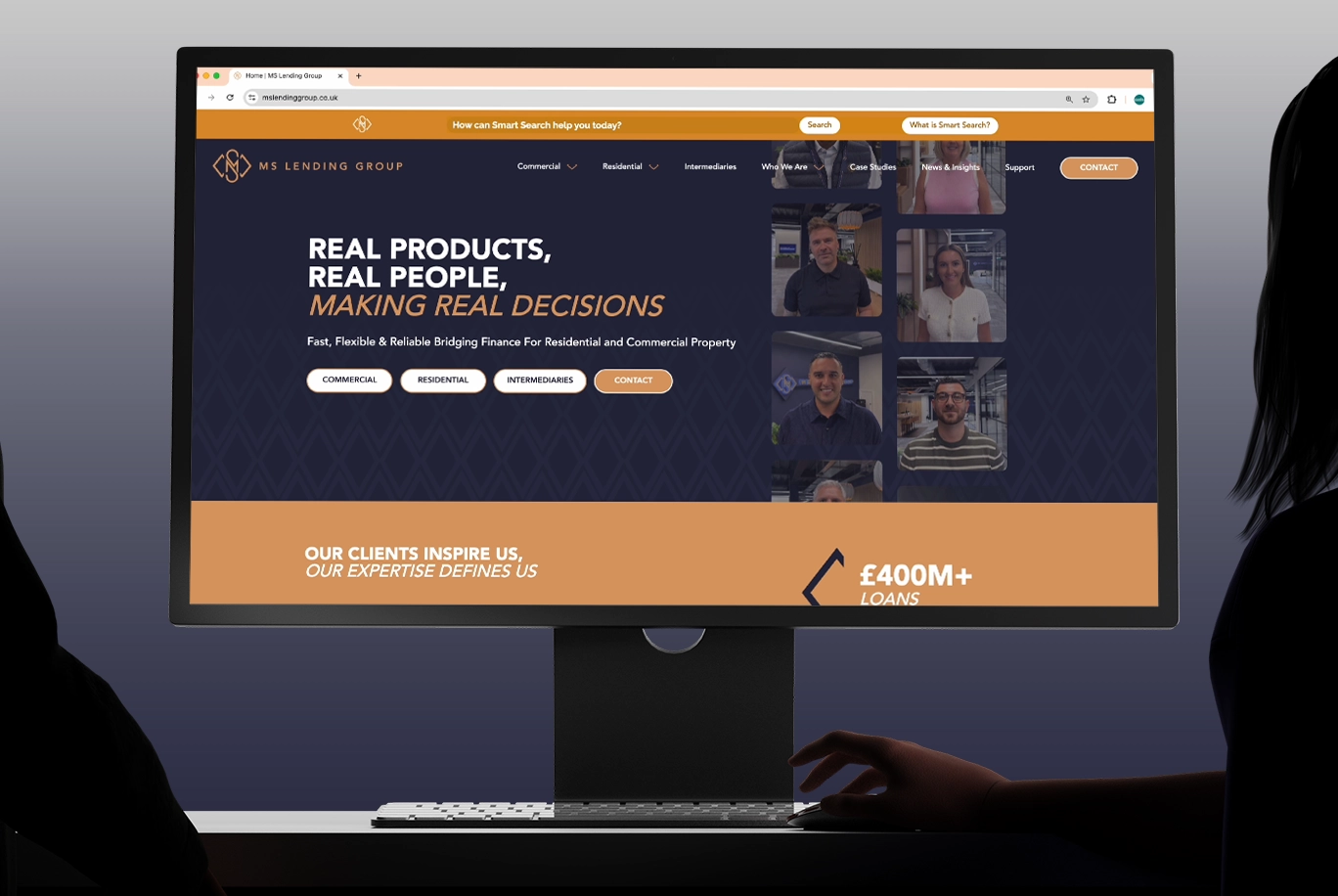

WEBSITE DESIGN & DEVELOPMENT

Full Send re-imagined the MS Lending Group website by migrating it onto a user-friendly CMS, giving internal teams the flexibility to update content quickly and easily. The redesign placed a strong emphasis on reflecting the brand’s distinctive style and positioning MS Lending Group as experts in the bridging finance sector.

To elevate the user experience, the site was enhanced with a market-leading natural language chat function, allowing visitors to access information instantly in a conversational way. In addition, Full Send developed a bespoke digital application form, streamlining the lending process for clients and creating a seamless, efficient journey from enquiry to approval.

SEARCH ENGINE & AI OPTIMISATION

Full Send implemented a comprehensive SEO strategy to drive growth in keyword rankings, web traffic, and leads for MS Lending Group. Our efforts resulted in significant success, securing prominent positions on Google's first and second pages for crucial search terms such as 'hmo bridging finance' and 'bridging loan no valuation'.

We conducted thorough keyword research to identify high-value terms relevant to MS Lending Group's target audience and services. This ensured that our optimisation efforts aligned with the search intent of potential customers. We developed a content strategy that focused on creating informative and engaging content around key bridging finance topics. This included blog posts, articles, and guides that not only helped improve organic visibility but also positioned MS Lending Group as an industry expert, driving organic traffic to their website.

In addition to traditional search engine optimisation, Full Send is pioneering innovative approaches to optimise content for AI search engines, including ChatGPT, Claude, and Google AI Overviews. Our forward-thinking strategies ensure that MS Lending Group's brand information appears prominently when users query these AI platforms about bridging finance solutions. This multi-channel visibility not only increases brand awareness but also generates higher-quality traffic as users click through to the website after engaging with the brand's information directly within AI search results.

Through our comprehensive SEO strategy, MS Lending Group experienced significant growth in keyword rankings, resulting in increased organic visibility on Google's first and second pages as well as across emerging AI search platforms. This enhanced search visibility across traditional and AI search engines not only drove more web traffic to their site but also resulted in a boost in qualified leads, promoting MS Lending Group's position as a leading provider of bridging finance in the residential, semi-commercial, and commercial property markets.